HIGHLIGHTS:

Making the Decision

Little Known Facts About Financial Aid Asking For More Money– Last Word Feeling Pressured to Borrow– Don’t Be

Financial Aid Insider– Thoughts on the Department of Education

Date: April 2025

Dear Parent,

It’s Spring and I thought sharing some common sayings and quotes about April, often associated with its weather and the beginning of Spring would be fun: “April is the kindest month. April gets you out of your head and out working in the garden.” “April, the angel of the months, the young love of the year.” “April prepares her green traffic light, and the world thinks, “Go!” “April showers bring May flowers,” “Men are April when they woo, December when they wed,” “No Winter lasts forever; no Spring skips its turn. April is a promise that May is bound to keep, and we know it.”

It’s Spring and I thought sharing some common sayings and quotes about April, often associated with its weather and the beginning of Spring would be fun: “April is the kindest month. April gets you out of your head and out working in the garden.” “April, the angel of the months, the young love of the year.” “April prepares her green traffic light, and the world thinks, “Go!” “April showers bring May flowers,” “Men are April when they woo, December when they wed,” “No Winter lasts forever; no Spring skips its turn. April is a promise that May is bound to keep, and we know it.”

Decisions, Decisions, Decisions

March is when the offers of admission and financial packages are in. The decision to accept an offer of admission and the college’s aid package (or perhaps no award package) will be made by National College Decision Day on May 1st.

Parents will want to review the financial aid awards before sending in the enrollment deposit. Last month’s newsletter covered whether you should accept them as is, negotiate for a better deal, or make an appeal based on changed financial circumstances.

Financial considerations notwithstanding, students need to choose their college wisely. The impact of a college education can last a lifetime.

As much as we discuss college affordability, money shouldn’t be the only deciding factor. And an institution’s prestige should not be the deciding factor. There are just too many variables that make up a college’s reputation, most of which have nothing to do with the quality of the education one receives. A degree should be much more than a just piece of paper. If that’s what a student is looking for, they can get that degree online for much less.

So, looking beyond the surface and focusing on academic programs, teacher-to-student ratios, internships, research opportunities, job placement, and outcomes for graduates is critical and should supersede rankings.

Last but not least, is the culture of the campus. Most students will feel lost for a few months, but by the end of the Christmas break, if there are enough students like them to find, they will have begun to feel more at home

Of course, the college itself should have enough opportunities for the student to continue activities they are already enthusiastic– I dislike the word passion– about and the chance to explore new interests. Having good reasons to spend weekends on campus rather than going home, go to provide a satisfying and memorable four years. For what parents are paying, their student should be ready to stretch, grow, and, as I like to say, “Suck the marrow from the bone.”

Little Known Facts About Financial Aid

Many colleges have an office of student enrollment. Enrollment managers oversee the entire student recruitment and enrollment process, from attracting prospective students to ensuring a smooth transition into the institution, often managing admissions, financial aid, and related services.

It’s important not to be intimidated by what the college tells you to pay. The closer May 1st gets, the more fluid the college’s position may become, making it likely your student can be awarded additional funding. It’s almost there for the asking. Your student may have already received a note from a college with more scholarships or grants. If they didn’t, have your student contact the college and ask them for help.

The phrase, “If you don’t ask, you don’t get,” is real. But some colleges, especially private colleges, are waiting for your student to reach out and ask for help, which is code for more free money. As I wrote, some will contact you first but don’t wait for them.

If you know what a loss-leader is, maybe this will give you more confidence: Long ago, colleges figured out that to get a student to attend, they may have to give up some money. If there is aid that is considered need-based, parents should ask financial aid, all things being equal (that is, no significant change of finances) if their student’s award will keep up with each year’s increase in tuition. This year I’m seeing an average increase of $4,000 in 2025-2026 tuition and fees from last year

If you know what a loss-leader is, maybe this will give you more confidence: Long ago, colleges figured out that to get a student to attend, they may have to give up some money. If there is aid that is considered need-based, parents should ask financial aid, all things being equal (that is, no significant change of finances) if their student’s award will keep up with each year’s increase in tuition. This year I’m seeing an average increase of $4,000 in 2025-2026 tuition and fees from last year

Don’t feel bad or intimidated asking for more funding. In reality, what you are asking for is a “tuition discount.” These tuition discounts are already part of the formula they use to attract students like yours. They are already baked into the cake, so to speak. Chances are better than 50-50 if you ask the typical private college for more money, the student will get more.

Asking For More Money– Last Words

You’re in the driver’s seat. Colleges go into panic mode every year, starting in late Winter and early Spring. A bunch of 17 and 18-year-olds are determining their very existence. They are literally at the mercy of teenagers. As May 1st approaches, the level of anxiety increases. Will the admission department (marketing) meet their magic numbers?

That’s the number of students they need to “make their class”. They need more deposits than the seats they have available. Shortly after seniors graduate from high school, something happens called the “summer melt”. The summer melt happens when students who have already committed, for various reasons, decide they aren’t going to that college.

When admission applications fall, as they have been

doing for several years, colleges do whatever they can to attract as many students as possible. As you know, not all students admitted to a given college will go. Let’s say 6,000 students are admitted and 1,080 send in deposits. The percentage of enrollees is 18%. This is known as the “yield”. This is very important to colleges. The average yield rate for private schools is 33%. Public universities have lower yields, averaging 25%.

Colleges are very interested in increasing their yield rate. The higher the yield, the less money they have to offer to get a student to sign on the dotted line.

You won’t get another bite at the apple. The first award package will be the best your student will ever get. So, get as much as you can now or forever hold your peace.

If you don’t ask, you don’t get. The magic formula is simple: ASK, an acronym for “Ask and you shall receive, Seek and you shall find, and Knock and it will be opened to you.”

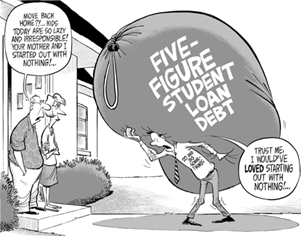

Feeling Pressured to Borrow– Don’t Be

Award letters typically include loans. There are two federal loans that new undergrads are offered. One is the Subsidized Direct Loan. Subsidized loans have the interest paid for them by the government for as long as the student is a half-time student or better. The other is the Unsubsidized Direct Loan, and it is exactly that. The interest begins to accrue immediately.

Award letters typically include loans. There are two federal loans that new undergrads are offered. One is the Subsidized Direct Loan. Subsidized loans have the interest paid for them by the government for as long as the student is a half-time student or better. The other is the Unsubsidized Direct Loan, and it is exactly that. The interest begins to accrue immediately.

Other than that distinction, the loans have exactly the same terms and features. Repayment on both loans begins six months after the student graduates, pauses classes, or drops out.

This year, more colleges are offering their own loans in student packages. Repayment terms vary, so knowing the commitment before accepting them will be very important. Keep in mind that loans are not aid.

Each month, we provide you with tips on your best ways to pay for college regardless of your financial situation.

Each month, we provide you with tips on your best ways to pay for college regardless of your financial situation.

There are no tips this month. This newsletter has always been non-political, and this is more of an editorial and only my opinion. It doesn’t represent everyone’s viewpoint. The Department of Education (ED) is being gutted by a very conservative wing of the electorate, meaning a minority of citizens support this. How this will affect college students is still up in the air.

Naturally, parents whose plans to pay for college include loans are concerned. It seems like an attack on higher education is part of a plan. It’s now the elites (the ultra-wealthy against the educated classes. A college education has never been for everyone. How that message developed is beside the point. However, those wanting a college education could very well face a system that limits access to capital, and flexible repayment plans will hurt those who desire one.

Of greater concern is what will happen to students in grades K-12. While state and local governments are responsible for the vast majority of America’s public education system, Congress created the ED to help bridge longstanding gaps in educational opportunity and provide critical funding and support to students. The ED fulfills that role by enforcing civil rights laws, supporting students with disabilities, promoting equal educational opportunities, bolstering the educator workforce, and administering the Federal Student Aid programs that place college within reach of working Americans.

Eliminating or effectively shuttering the Department puts at risk the millions of vulnerable students, including those from low-income families, English learners, homeless students, rural students, and others who depend on ED support.

It also jeopardizes more than 400,000 educator jobs; makes it impossible for the

ED to ensure that federal education funding actually is spent as Congress intended; threatens support for 7.5 million students with disabilities; and leaves millions of students vulnerable to discrimination. It could also reduce access to Pell Grants, upend repayments for student loan borrowers, and invite fraudulent and predatory behavior from unscrupulous higher education institutions.

Mara Greengrass, a Maryland mother, says, “As a parent of a child with disabilities who has an Individual Education Program (IEP), I am deeply troubled by the severe cuts the Trump Administration has made to the Department of Education.” “Funding for special education and the Department’s oversight have been crucial in ensuring my son receives the quality education he– and every child in this country– deserves.”

Food for thought.

Until next month…

This material was created to provide accurate and reliable information on the subjects covered but should not be regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services of an appropriate professional should be sought regarding your individual situation.

Bob Chitrathorn is a registered representative with, and Securities and Retirement Plan Consulting Program advisory services are offered through LPL Financial, a registered investment advisor, member FINRA/SIPC. Other advisory services offered through Mariner Independent Advisor Network. Mariner Independent Advisor Network, Wealth Planning by Bob Chitrathorn, and Simplified Wealth Management are separate entities from LPL Financial.

This material was prepared for Bob Chitrathorn’s use.

P.S. If you find this newsletter helpful, please share it with other parents like yourself!

Copyright © 2012-25 CTS, Inc. All rights reserved.

CONNECT WITH BOB