Risk Analysis

Building Your Investment Strategy Using Riskalyze

Stereotypes Don’t Work

For decades, the industry has followed the same thought patterns: young people have time to make up for market losses, so they must have an aggressive risk tolerance; whereas, older investors need to preserve the wealth they’ve already built, so they must have a conservative risk tolerance. Everyone else? Dashes of both. Did you know that, in most cases, those assumptions are dead wrong?

How Riskalyze Can Help

Riskalyze is cutting edge technology that identifies your acceptable levels of risk and reward. Using this tool, we ensure that your portfolio defines your investment goals and expectations.

Together we can take the guesswork out of your financial future.

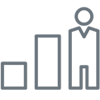

Capture Your Risk Number®

The first step is to answer a 5-minute questionnaire that covers topics such as portfolio size, top financial goals, and what you’re willing to risk for potential gains. Then we’ll pinpoint your exact Risk Number to guide our decision making process.

Align Your Portfolio

After pinpointing your Risk Number, we’ll craft a portfolio that aligns with your personal preferences and priorities, allowing you to feel comfortable with your expected outcomes. The resulting proposed portfolio will include projections for the potential gains and losses we should expect over time.

Define Your Retirement Goals

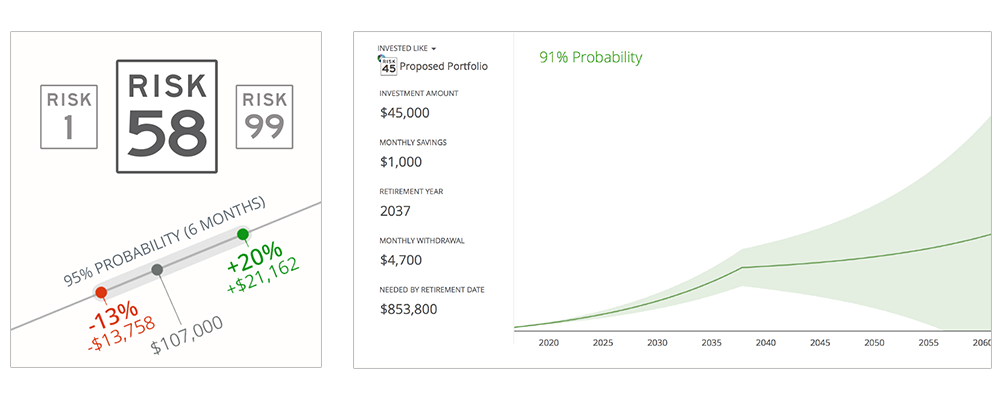

We will also review your progress toward your financial goals by building a Retirement Map.

When we are finished, you’ll better understand what we can do to increase the probability of success.

Meeting Your Retirement Goals

Screenshots: Risk Number® and sample six-month 95% probability range (left), and a sample Retirement Map (right).

CONNECT WITH BOB