Guided Wealth Portfolios

Start Investing for Your Future Today

Invest for your future with our new online platform that combines the benefits of a personal financial advisor with sophisticated technology. You still get the Simplified Wealth Management experience and expertise, but with the added convenience and transparency of an automated investing solution. Guided Wealth Portfolios (GWP) provides you personalized, objective investment advice through an online platform with 24-7 access to your accounts.

While other digital investing solutions, or robo advisors, offer online investment management, most don’t include a direct personal relationship with a dedicated financial advisor. With GWP, we’ll be your personal advisor [team], dedicated to you and your goals, helping to guide you through the investing process. Our Guided Wealth Portfolios service offers:

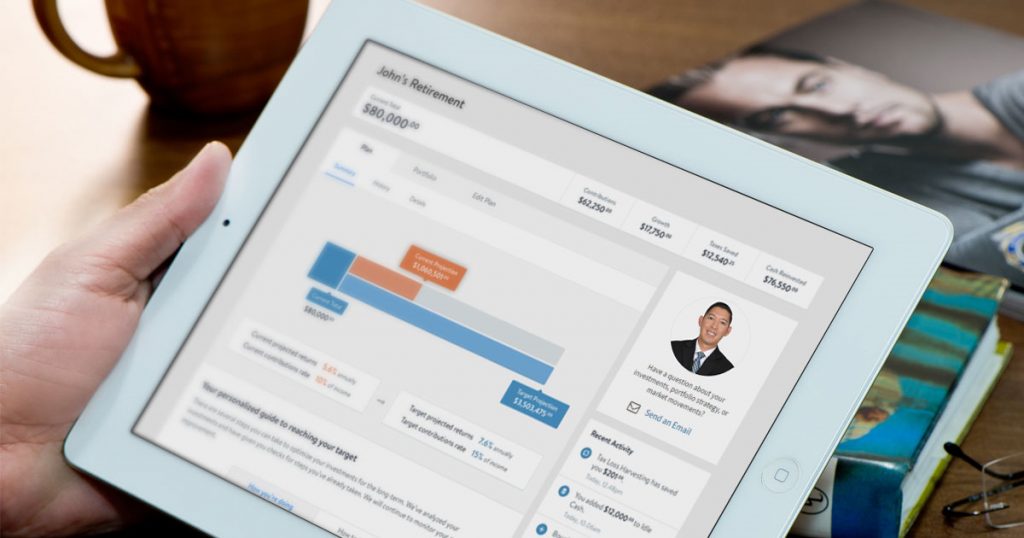

- Personalized planning, service, and advice: The path to your financial goals is personalized for your specific stage in life, and will change as your life changes. If you ever have any questions, your advisor is only a phone call away.

- Intuitive, intelligent technology: See your GWP accounts in one place, open new accounts, view your portfolio, and make updates via your personal portal. The technology makes the process fast and easy.

- Advanced wealth management at a lower cost: We can implement your personal roadmap using proven investment techniques. Receive allocations designed for you and your savings goals, and benefit from trading techniques that may increase diversification and can help reduce taxes.

Whatever Your Retirement Goals, We Can Help You

Intelligent Investing

Guided Wealth Portfolios offers investment management designed to protect your portfolio against volatility and help you pursue your financial objectives. By investing with us, you receive:

Personalized roadmap – Based on your goals, investing time horizon, and risk preferences, you’ll receive an investment allocation and roadmap designed to help you pursue your objectives. As you get closer to retirement, your allocations will gradually change.

Holistic advice – By considering your retirement objectives and investments, our analysis allows you to work toward your investment goals.

Tax-efficient investing – Through advanced asset analysis, we’ll allocate your assets in a tax-efficient manner, and evaluate the tax impact of each trade before it goes through.

Consistent monitoring – Your portfolio is monitored daily, keeping it on track as markets move, and rebalancing it as needed.

Tax-loss harvesting – If an investment experiences a loss, we may sell it to offset taxable gains in your portfolio. The investments sold are replaced by similar investments to maintain your asset allocation, so you get tax benefits while keeping a properly diversified portfolio.

Financial advice – We’re available if you have a question about your account or investing strategy.

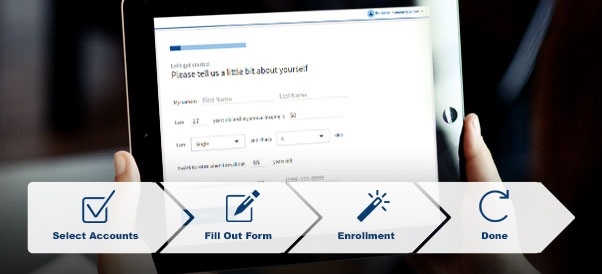

Start Today

To get your dynamic proposal and start investing for your future today, click here

How It Works

Enrollment Video

Guided Wealth Portfolios (GWP) is a centrally managed, algorithm-based, investment program sponsored by LPL Financial LLC (LPL). GWP uses proprietary, automated, computer algorithms of FutureAdvisor to generate investment recommendations based upon model portfolios constructed by LPL. FutureAdvisor and LPL are non-affiliated entities. If you are receiving advisory services in GWP from a separately registered investment advisor firm other than LPL or FutureAdvisor, LPL and FutureAdvisor are not affiliates of such advisor. Both LPL and FutureAdvisor are investment advisors registered with the U.S. Securities and Exchange Commission, and LPL is also a Member FINRA/SIPC.

All investing involves risk including loss of principal. No strategy assures success or protects against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

References to tax strategies that the GWP service investment management considers in managing accounts should not be confused with tax advice. LPL Financial does not provide tax advice. Clients should consult with their personal tax advisors regarding the tax consequences of investing.

CONNECT WITH BOB