Call It Market Updates

Markets are doing their thing again, so let’s discuss.

Markets tumbled, heading into negative territory, and then bounced back. And then promptly fell again.1

We’re caught in a whipsaw pattern of uncertainty.

Is this weird?

Not really. These things happen pretty regularly when investors get jittery.

Let’s talk about what’s going on.

(Scroll to the end if you just want my takeaways.)

What led to the selloff?

Phew. There’s a lot going on.2

There’s yet another debt ceiling deadlock between Congress and the White House.

Worries about the banking sector continue.

Sticky inflation is still on everyone’s radar.

And then there’s the endless speculation about recessions and what the Federal Reserve might do next.

All these stressors lead to jumpy investors and nervous markets.

Could we see another serious correction?

Absolutely. If the debt ceiling standoff drags on or more bad headlines appear, markets could react negatively.

And, corrections and pullbacks happen very frequently because there’s always something going on.

How often? Let’s go to the data.

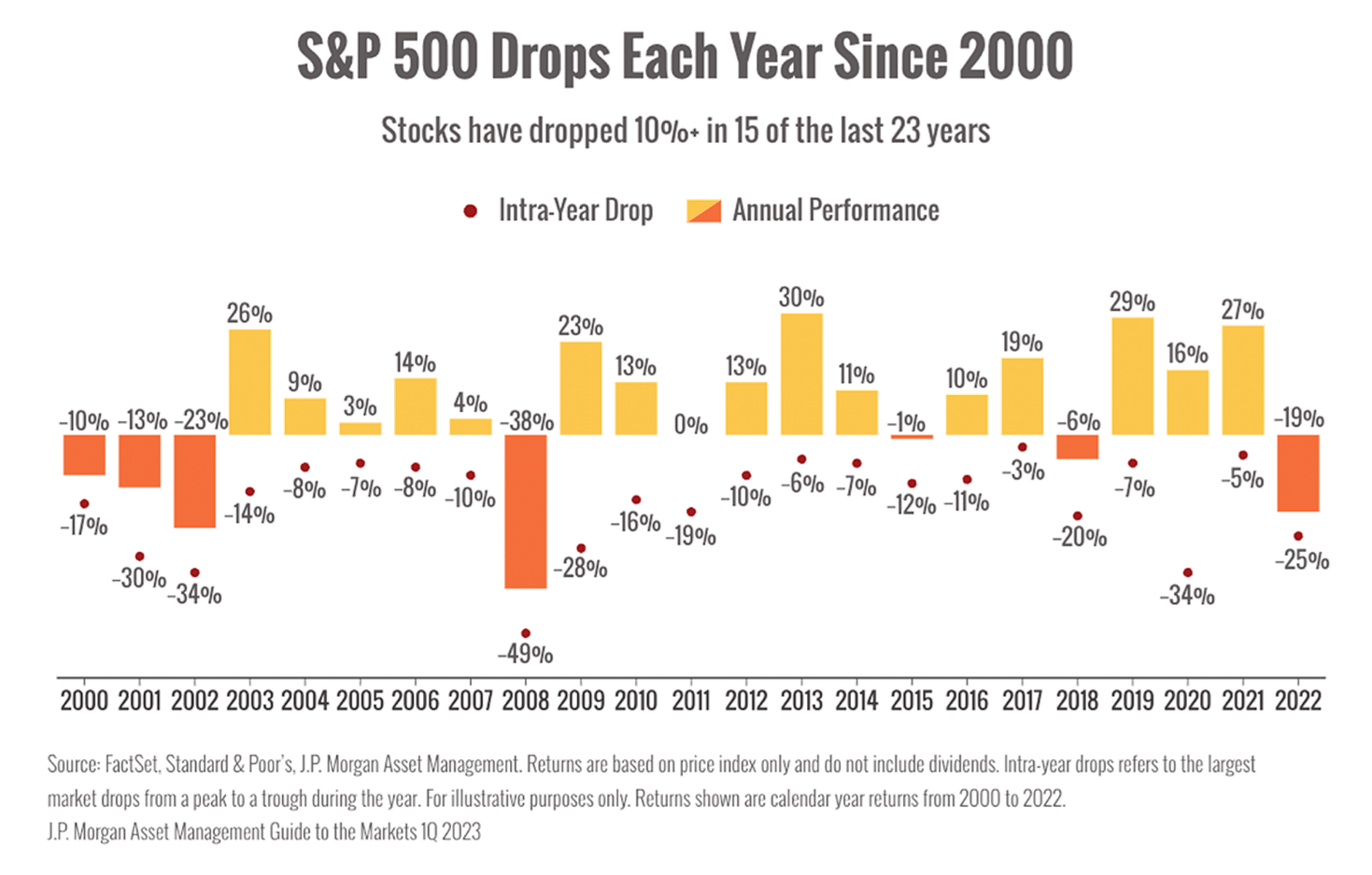

Here’s a chart that shows just how often markets dip each year. (You may have seen this chart before because it’s an oldie and goodie.)

Take a look at the red circles to see the market drops each year.

The big takeaway? In 15 of the last 23 years, markets have dropped at least 10% each year.3

Market pullbacks happen all the time.

We’re dealing with a lot of uncertainty and investors are feeling cautious.

However, that doesn’t mean that we should panic and rush for the exits.

Markets are going to be turbulent this year and knee-jerk reactions can be costly.

I don’t have a crystal ball, so I don’t know how it’s all going to play out, but this situation isn’t surprising.

We expected volatility and we’re prepared.

I’m watching markets closely.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

All investing involves risk including loss of principal. No strategy assures success or protects against loss.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

CA Insurance License # 0E63308

Bob Chitrathorn is a registered representative with, and securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through Strategic Wealth Advisors Group, LLC, a registered investment advisor. Strategic Wealth Advisors Group, LLC. and Simplified Wealth Management, Inc are separate entities from LPL Financial.

CONNECT WITH BOB