13 POTHOLES to Avoid on the Road to Retirement

1. NOT HAVING A MONTHLY BUDGET

A budget is a spending plan based on your income and how much money you will spend over a set period, such as a month. Following a budget can help create financial stability because it provides an easy way to track your bills, make payments on time, help build savings, and provide you with a plan to pursue day-to-day financial confidence. The four parts of a budget are:

-

- Net income is your wages minus taxes, retirement savings contributions, insurance, and anything else deducted from your paycheck.

- Fixed expenses are the same each month and are generally necessary—for example, your mortgage, rent, or car payment.

- Flexible expenses change month-to-month and are primarily necessary expenses. Examples of flexible expenses include groceries and utility bills.

- Discretionary expenses are your wants that aren’t always necessary expenses, but you still buy them. Discretionary expenses include gym memberships, dining out, and home improvements.

Now that you understand the benefits of having a budget, use this tool by subtracting the three types of expenses from your net income to find extra money to save for your retirement and financial goals. A financial professional can work with you to develop a monthly budget for your situation.

Perhaps you’re just starting to save for retirement, or within a few years of retiring. Unfortunately, it’s common to take a wrong turn or make bad financial decisions, as you continue on your journey toward retirement. By thinking ahead and being prepared, you may be able to avoid the common mistakes that can hinder your progress toward your retirement goals.

This guide will help you identify several potholes that can wreck your best-laid plans for retirement and provide recommended actions to help keep you on the road toward being financially confident throughout retirement. Your decisions and actions matter when it comes to saving for retirement, and can also impact your financial independence today. Avoiding the following thirteen potholes can help you steer clear of critical damage to your retirement plans.

2. TOO MUCH DEBT

Having debt can negatively affect your ability to save for retirement and other financial goals. Being debt-free is possible for everyone, regardless of income. When you learn to manage your debt and control your spending habits, you can start to focus on saving and building your net worth. Here are three methods to help manage your debt:

-

- Debt Snowball Pay off your smallest debt first by applying additional money toward your lowest interest-rate balance while paying the minimum payment on the rest of your credit accounts.

- Debt Avalanche Pick the debt with the highest interest rate and pay that one off first by making additional payments while making the minimum payments on the rest. Once the highest-interest-rate debt is gone, move on to the next highest-interest-rate debt and repeat until your debt is gone.

- Debt Consolidation Pay down high-interest debts first by consolidating them into one lower-interest rate debt to help impact the outstanding balance more quickly and pay less interest.

It’s important to continue saving for retirement by contributing enough to your 401(k) to receive your employer’s match while you continue to pay off your debt. Work with a financial professional as an accountability partner to help you stay on top of your debt management plan and develop a strategy to save for retirement.

3. NO EMERGENCY FUND

An emergency fund is six to nine months of expenses in a savings account to use for emergencies and help mitigate financial stress as you improve your financial confidence. Suppose you don’t have an emergency fund and a financial crisis occurs. In that case, you may have to liquidate your retirement savings or other assets as you aim to cover your living expenses and financial obligations. Emergency funds help provide financial resources during:

-

- Illness, death, or disability in the family

- Unemployment

- Urgent medical procedures

- Emergency home repair

- An unforeseen auto repair

You may want to consider having more than six months saved, depending on your situation, such as:

-

- How many people live in your household

- Your monthly income

- The amount you need to cover your monthly expenses

Since the emergency fund is for emergencies, it shouldn’t contain retirement savings or other securities-related assets, or require paying interest like a credit card.

4. LIVING BEYOND YOUR MEANS

If you run out of money before the month is over and don’t know where it is going, it may be a sign that you are living beyond your means. Often, you may not even be aware you are doing it. Spending more than you make may cause you to use a credit card or loan, or to tap into your emergency fund or retirement savings prematurely, which can lead to debt and keep you from pursuing your financial goals. Here are some signs that you may be living beyond your means:

-

- You live paycheck to paycheck.

- You aren’t saving into an emergency fund, regular savings, or retirement savings.

- You carry your credit card balances month over month.

- You are paying high interest rates on debt.

- You’re paying late fees or overdraft fees.

- You can’t get a loan.

A financial professional can help you identify overspending, develop a budget, and determine a method to track your progress that is appropriate for your situation.

5. WAITING TOO LONG TO START SAVING FOR RETIREMENT

When it comes to saving for retirement, the clock is ticking. According to a survey by the Federal Reserve, most non-retired adults have some retirement savings. Still, fewer than 4 in 10 who participated in the survey thought their retirement savings were on track. Often, the ability to save for retirement results from the decisions we make or fail to make.

If you start saving in your 20s, contribute 10%–15% of your paycheck, and receive your employer’s match, you can confidently work towards your retirement savings goal. However, with every decade you delay, you’ll need to save a significant percentage of your paycheck. Take advantage of managing your retirement savings contributions with these tax-advantaged strategies:

401(k), 403(b), and 457(b) plans

Employees can contribute pre-tax dollars to their employer’s retirement savings plan and generally receive an employer match.

Roth IRA

Individuals fund a Roth IRA with after-tax contributions, so you pay taxes upfront. When you take distributions, both the contribution and accumulation are tax-free. Contributions are withdrawn tax and penalty-free for emergencies, home purchases, and more. However, drawing the accumulation before age 59½ will result in a 10% IRS penalty.

Anyone can open a Roth IRA at any age, as long as they have income. Income limits apply to those who are eligible to contribute and generally vary from year to year. Reach out to your financial and tax professionals to determine if you are eligible to contribute and what the contribution limits for this year are.

Traditional IRA

This type of IRA is funded with pre-tax contributions, which grow tax-deferred. Distributions from IRAs are taxed at the owner’s tax rate and are penalty-free if taken after age 59½. If distributions occur before age 59½, they tax as ordinary income and an early distribution penalty of 10% applies.

Here are a few other things about IRAs:

-

- Traditional IRAs have no income limits to contribute.

- If you’re eligible for the tax deduction on your contributions, you can claim it whether or not you itemize deductions on your tax return.

- If you participate in your employer’s retirement savings plan, you may not be eligible to contribute to a traditional IRA.

Work with a financial professional to help determine how much more you need to save towards your retirement savings to pursue your goal. They can help you identify other retirement savings strategies based on your goals and unique situation.

6. BORROWING FROM YOUR RETIREMENT SAVINGS OR CASHING IT IN

If you cash out your retirement savings before age 59½, your plan sponsor will withhold a 10% IRS penalty and taxes. Most people never catch up once they cash in their retirement savings account.

If you take a loan from your retirement savings, you need to understand that interest is applied, and you can’t make contributions until the loan is paid. What are other options besides borrowing or cashing in your retirement savings?

-

- Take an unsecured loan from your bank to avoid the 10% penalty and pay taxes on the distribution.

- Sell non-retirement assets instead of using your retirement savings.

- Stop retirement savings contributions and use the extra cash.

- Consult a financial professional to determine other ways to access cash versus borrowing from your retirement savings or cashing it in.

7. FAILING TO HAVE A FINANCIAL PLAN

As they say, failing to plan may be a plan for failure. If you don’t have a financial plan, you may not know how to pursue your goals or improve your current financial situation. Financial planning is often complex since it involves multiple areas of finance, such as budgeting, debt management, savings, retirement planning, insurance, and estate planning. Financial planning may also include holistic planning, which focuses on working towards your life goals by properly managing your financial resources, health, and other aspects of life.

Once you have a list of recommended actions, you can strive toward improving your financial situation to help you manage your goals. Whether you pursue financial planning independently or with the help of a professional, your financial plan should include:

-

- How you can get out of debt.

- What you can do differently to save money.

- How much to keep in your emergency fund?

- The types of retirement savings strategies that are appropriate for your situation.

- How much money do you need to save to pursue your retirement goals?

- If you have adequate types of insurance for your situation.

- How to improve your tax situation.

- How to adequately save for your child’s education.

8. NOT ENOUGH INSURANCE COVERAGE

The idea of paying for insurance can feel daunting, but its meaning is simple: insurance can help you avoid financial hardship. Insurance may help provide for lost income, cover bills and debts due to death or disability, help pay for living expenses or cover property damage or loss. Adequate coverage can also help with funeral expenses and long-term care.

Here are some questions your financial or insurance professional will ask to help determine how much insurance is appropriate for you:

-

- Are you financially responsible for others?

- Do you have debt?

- Do you have enough money to cover your debts and expenses related to death—funeral, estate taxes, attorney fees, and other costs?

- Can you replace your possessions if a loss occurs?

- Can you privately pay for your long-term care?

- Do you live in an area prone to natural disasters such as fire, flood, or tornadoes?

- Has your family changed, grown, or moved away?

- Are there any new drivers in your family?

- Are there changes that will influence the amount of insurance you may need?

If you do not have adequate insurance coverage, your retirement savings and other assets may have to be liquidated to cover expenses related to the loss. A financial professional can help you review your insurance policies to help you determine if you are underinsured.

9. NO ESTATE PLAN OR LEGAL DOCUMENTS

Estate planning and having your legal documents in place is something that everyone should do, regardless of age, marital status, or whether they’re a parent or not. According to a 2021 poll by Gallup, slightly less than half of U.S. adults (46%) have a will that describes how they would like their money and estate to be handled when they die.

Also important is naming who will handle your finances if you cannot do so, or make medical decisions for you on your behalf.

Do you have these legal documents in place?

-

- A will Writing a will can help determine where assets that don’t have a beneficiary listed will go. Everyday items listed should include your home (if paid off), cars, collections, and even household Bank accounts and brokerage accounts with no beneficiary listed should be in your will and estate plan, with the terminology appropriate to these types of assets.

- An ‘Executor’ of your estate Commonly, this is a relative or friend, but a professional manager may be considered for more complex cases where there are substantial assets.

- A Guardian for your underage children If you have a young family, your estate plan should include who you would like to care for your children if both parents are deceased. Without this directive, the state of your residence decides who will be the guardian of your children. This could mean your children may be appointed a guardian you would otherwise not have agreed to. If a child has special needs, planning for the child’s care now and after age 18 throughout their adulthood should be considered.

- Medical Power of Attorney Commonly, spouses list each other as Medical Power of Attorney, but you have the full authority to list anyone you choose. A medical power of attorney makes medical decisions for you if you cannot.

- Financial Power of Attorney This individual has the authority to pay your bills and manage your finances for you if you are unable to Choosing a financial power of attorney is critical if you require extended medical or nursing care so your bills are current and you can remain in the care facility. Without having a Financial Power of Attorney named, your assets are seized and liquidated by the state to pay your bills, even if you have the assets to pay.

- Trust Document A Living Trust allows you to pass assets without going through probate and allows someone else to handle your financial affairs if you’re unable to. A trust document names the ‘trustees,’ who the trust benefits, and a successor trustee who will take over when the trustees cannot manage their affairs or pass away. A trust document is a crucial element in estate planning.

Although these are the main parts of an estate plan, they may not be all you need, depending on your unique situation. Working with your financial, legal, and tax professionals can help you feel confident that your wishes will be carried out properly and how you intended.

10. RETIRING TOO EARLY

Unfortunately, retiring too early can be a financial mistake because it may significantly impact your retirement savings. Often, working just a few more years can make a difference for these reasons:

-

- Contributions into retirement savings can continue

- Retirement savings can continue to accumulate

- A higher Social Security monthly benefit amount

It is essential to determine how long your nest egg will last based on longevity scenarios and your Social Security retirement benefits. A financial professional can work with you to help determine a suitable time for you to retire based on your situation. Before you decide to retire early, you should consider these things:

-

- The cost of healthcare

- Social Security retirement benefits

- Retirement savings distributions

- How long your nest egg may last

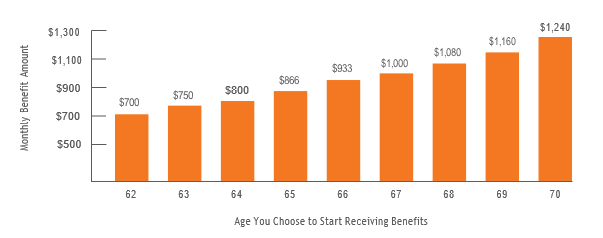

Monthly Benefit Amounts Differ Based on the Age at Which You Start Receiving Benefits

This example assumes a benefit of $1,000 at a full retirement age of 67.

-

- How taxes will impact your Nest egg

- How a bear market may impact your portfolio

- How inflation will impact your portfolio

When should you start Social Security retirement benefits?

Once you turn 62, you can decide when to take Social Security retirement benefits, as your decision may cost thousands of dollars. Here’s what impacts your monthly benefit amount:

-

- You need at least ten years of full-time work (40 credits).

- The amount of your benefit is based on your highest 35 years of earnings.

- If you have fewer than 35 years of earnings, years without work count as 0 and may reduce your monthly benifit.

While your expectation about the timing of taking Social Security retirement benefits is unique to your situation, the U.S. Social Security System provides reference points for typical retirement ages. Eligible individuals can begin to draw Social Security retirement benefits as early as age 62, but benefits will be reduced. Unreduced benefits are available at full retirement age, which varies from age 65 to 67 depending on your birth year.

That’s a lot to consider! A financial professional can help you run scenarios based on your portfolio’s value today, assumed taxes, healthcare costs, inftation, Social Security retirement benefits, and more.

11. FORGETTING ABOUT TAXES

Tax planning is essential while you’re still working, but also as you approach retirement, and during retirement. Why? Because not planning for taxes can cost you more at tax time or create a future tax headache for your heirs. Here are some scenarios where tax planning with a financial professional may help:

Income and Capital Gains Taxes

Financial professionals look for income in your portfolio, whether from qualified dividends, ordinary dividends, or tax-free income. Your tax bracket helps determine what strategies are appropriate for your portfolio based on your situation, both for growth and from a tax savings perspective. You may have carry-forward losses from a bad year which will offset increases from another investment. A lot is determined by reviewing your tax return.

Missed Deductions and Opportunities

It’s common for investors to miss out on deductions they could be taking, or maybe their accountant wasn’t aware they could take. These deductions can result from a payroll deduction W-4 form incorrectly filled out, missed deductions for college savings plans, long-term care premiums (if they exceed 7.5% of your adjusted gross income), and health insurance if you’re self-employed.

Charitable donations using Qualified Charitable Distributions (QCDs)

If you’re 70 1/2 or older, you can use a QCD to donate directly from your IRA to the charity of your choice. While the gift amount won’t qualify for a charitable deduction, it won’t be considered taxable income either. This tax-planning strategy enables you to deduct the amount transferred to the charity from your taxable income. In addition to reducing your taxable income, a QCD may be an appropriate strategy for your situation if you won’t reach the level of itemized deductions to exceed the standard deduction amount but would still like to make charitable gifts.

Charitable donations using Donor-Advised Funds (DAFs)

You can donate cash or other assets to a charitable investment account and receive a tax deduction immediately with a DAF. Since a DAF will grow tax-free, you may choose to distribute funds over time to organizations and causes that are important to you. If you time your contributions to coincide with higher-income years, you may enjoy a more significant tax deduction.

Check your payroll deductions

It’s important to evaluate if the correct amount of taxes are withheld from your paycheck each month. If you are an employee, the IRS withholding calculator can help you determine whether you need to update Form W-4 to avoid having too much or too little federal income tax withheld from your paycheck.

A financial professional can help you determine what tax-advantaged strategies are appropriate for you after reviewing your tax situation.

12. SELDOM REBALANCING AND MANAGING PORTFOLIO RISK

Your portfolio should align with your risk tolerance, retirement timeline, and long-term goals. These factors may help you decide on the appropriate asset allocation for your unique situation. When you rebalance your portfolio, you sell off higher-performing strategies, reinvest the returns, or invest the return into other strategies. However, if you haven’t rebalanced your portfolio in the last year, your risk tolerance may not align with the portfolio’s risk number. Rebalancing an investment portfolio can be challenging. Here’s what you need to consider before rebalancing your portfolio:

First, the tax implications that come with rebalancing. While you don’t have to worry about taxes with tax-advantaged accounts like 401(k)s, you will be responsible for capital gains tax on taxable accounts. Consult your tax and financial professionals to help you determine how rebalancing will impact your taxes.

Second, if selling the strategies in the asset classes that have exceeded the planned allocation aligns with your goals.

Third, determine if you want to invest in the asset classes that have fallen below your desired allocation, invest in new strategies aligned with your risk tolerance, time horizon, and goals, or stay in cash to reinvest later. Have a financial professional reassess your risk tolerance and determine if you may want to rebalance, how it will impact your taxes, help with the process, and implement new strategies appropriate for your situation.

13. FAILING TO CONSIDER OTHER WEALTH-BUILDING STRATEGIES

Regarding building wealth, there are different strategies besides a 401(k), IRA, Roth IRA, or other employer-sponsored retirement savings plans that may be appropriate for your situation, risk tolerance, and timeline. Here are other wealth-building strategies to consider:

REITs Real estate investment trusts (REITs) consist of real estate assets that typically produce income at different times. REITs must distribute 90% of their taxable income as dividends to investors.

Dividend-paying stocks Dividend-paying stocks may pay higher dividends than interest-rate sensitive strategies or depository products. The combination of price growth potential and income may outperform inftation over time. Dividend-paying stocks come with risks, so it’s essential to determine if they are an appropriate strategy for your portfolio.

Short-term debt Shorter-term bonds such as Treasuries have an inverse correlation to the stock market and tend to rise in price as stock prices fall.

TIPS Treasury inftation-protected securities (TIPS) are indexed to inftation and twice a year payout at a fixed rate. TIPS come in three maturities: five-year, ten-year, and 30-year. Meet with a financial professional to review your portfolio’s strategies and determine other wealth-building strategies that align with your risk tolerance, time horizon, and goals.

CONNECT WITH BOB