Federal Student Loan Interest Rates Set to Increase for 2021-2022

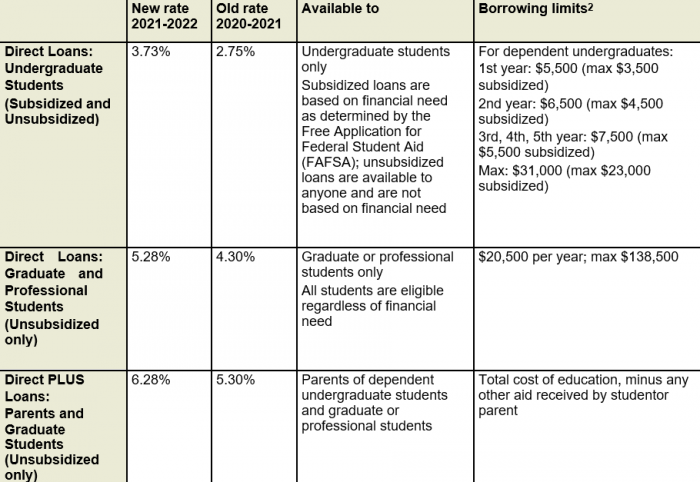

After two years of decreases, interest rates on federal student loans are set to increase almost a full percentage point for the 2021-2022 school year.1 The interest rates on federal student loans are reset each year after the May auction of the 10-year Treasury note.

The rates apply to new federal student loans issued on or after July 1, 2021, through June 30, 2022. The interest rate is fixed for the life of the loan.

Subsidized vs. unsubsidized: what’s the difference?

With subsidized loans, the federal government pays the interest that accrues while the borrower is in school, during the six-month grace period after graduation, and during any loan deferment periods. With unsubsidized loans, the borrower is responsible for paying the interest during these periods. Only undergraduate students are eligible for subsidized loans, and eligibility is based on demonstrated financial need.

1) The New York Times, May 28, 2021

2) U.S. Department of Education, 2021

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

The information provided is not intended to be a substitute for specific individualized tax planning or legal advice. We suggest that you consult with a qualified tax or legal professional.

LPL Financial Representatives offer access to Trust Services through The Private Trust Company N.A., an affiliate of LPL Financial.

LPL Tracking #1-05159484

CONNECT WITH BOB